In the modern economy, credit is everything. From the perspective of lenders, customers are only as trustworthy as their credit rating. But what is this all-important metric, and how can you make sure that yours is as robust as possible?

This article will lay out some of the best ways to check and monitor your credit score in Canada. Staying on top of borrowing and debt isn't always easy, but with the right tools at your disposal, it's much easier to protect your credit rating and access funds whenever you need them.

What is a good credit score in Canada?

First off, some basics. Credit refers to the act of lending money, which tends to mean banks and mortgage lenders in Canada. This often boils down to an assessment of how trustworthy individual borrowers are, which is based on their history of borrowing and repayments, among other things. If this checks out, lenders will look upon you much more favorably.

However, banks can't be expected to research every single transaction or promise a person has made in their life. That's where credit scores come in. These scores represent a rough measurement of trust, and it can fluctuate depending on how people behave.

In Canada, credit scores are graded from a baseline of 300 to 900. When you first start borrowing, you enter at 300 and through good financial behavior, you can rise up the scale. Anything above 650 is usually deemed to be a solid rating, opening up all sorts of lending.

Ways to raise your Canadian credit score

As we noted earlier, credit scores aren't fixed. They change all the time, and you can improve them through your financial actions.

Some common influences on credit scores include regularly switching jobs or having long periods out of work, and having relatively high credit balances on numerous accounts. So if you have a lot of debt in multiple places, that's a red flag.

However, here's the tricky thing. Having no debt is just as bad. If you don't have a mortgage or you haven't taken out any loans, credit raters will struggle to assess your worthiness.

Then there are simple errors. Credit ratings are based on individual files, and these files can contain mistakes. Mistakes range from incorrect social security numbers to wrong addresses, payments made on your accounts by fraudsters, or mistakes made by banks regarding late payments.

Here's where it pays to carry out thorough credit checks. By assessing your debt and checking for mistakes, you can often make big leaps up the credit hierarchy.

How to check your credit score for free in Canada

Thankfully, if you want a free credit check Canada offers plenty of options. Most importantly, any citizen can request their credit file by mail. Your file will be held by two major credit bureaus called TransUnion and EquiFax, who are obliged to supply a copy of your file.

To make a postal request, you'll need to provide the bureaus with two pieces of identification. Photocopies will do, so you don't have to mail your driver's license or passport.

However, the bureaus don't make it as easy as they could to make a free request. They are in the business of credit rating, so their websites try to sell online assessments instead of directing users to free mail-out versions.

Information about how to make a request can be found here and here, but there may be an easier option. Some organizations like Credit Karma allow customers to ask for a free credit report online. So it might not be necessary to wait for a mailed report to arrive.

If you want to contact the bureaus directly, here is the Equifax phone number: 1-800-465-7166 and the TransUnion phone number: 1-800-663-9980.

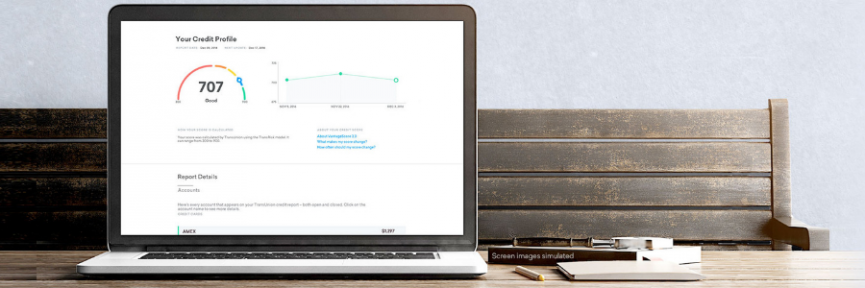

Credit Karma review: The right option for Canadian credit checks?

Credit Karma is a relatively new online business which specializes in allowing customers to access free credit data from both Equifax and TransUnion. Both bureaus have had poor track records of customer service in the past, so Credit Karma has occupied a natural niche, making things simpler and easing the hassle of checking Canadian credit ratings.

When you request your credit file via Credit Karma, you don't just receive the basic file. The company also highlights important passages in the document, making it easier to comprehend. And they present your data alongside information about how to improve your credit rating - enabling you to take the appropriate action.

Moreover, Canadians are only allowed by law to make one request from TransUnion and Equifax every year. But with Credit Karma, your file will be updated weekly and you can consult it whenever you like - major upgrade.

The company doesn't make any money directly from selling credit checks. Instead, they raise revenue from advertising. So, whenever you make a credit file request from Credit Karma, expect to encounter a few ads while you assess your financial situation.

Some users have questioned whether Credit Karma is too close to major credit card companies who advertise with them. When you use their site, you'll definitely be recommended certain accounts and services, but they tend to be relevant to individual needs, and there's no obligation to use them. Then again, users have also complained about receiving high volumes of emails from Credit Karma, which can be an annoyance, for sure.

So, aside from the issue of advertising, what's not to like about Credit Karma? Well, there are some things to think about. Most importantly, Credit Karma use a system known as Vantage 3.0 to arrive at credit scores, while most banks use the FICO grading system. The two are very similar, but some users have reported slight discrepancies between their Credit Karma score and the score assigned by lenders. So bear that in mind.

Another think to think about is security. Credit Karma has had security issues regarding its app in the past, but these were resolved in 2014, and since then their reputation has been fairly solid. They have instituted 128-bit encryption for all users, offer two-factor authentication of you want it, and undertake never to sell personal information to marketers. So safety isn't the major concern.

Credit monitoring tips for Canadians

As we've seen, Credit Karma offers a pretty reliable answer to how to check your credit score in Canada. It's free and draws on TransUnion and Equifax data, and you won't need to wait weeks for a mailed out report to arrive.

But even though Credit Karma is relatively informative and helpful, it's not as comprehensive as paid credit monitoring services. Credit monitoring essentially outsources the work of checking your credit file. So, if a mistake is made by your bank or you somehow become the victim of identity theft, credit monitoring companies should pick this up and suggest the right course of action.

Popular credit monitoring options include packages offered by the big two bureaus. For instance, Equifax Protect offers WebDetect, which provides instant fraud alerts, scans social media for possible identity theft and lets you know about any changes to your credit score. TransUnion offer a similar service, featuring credit alerts and a debt-to-income calculator which helps to put debt issues into perspective.

Alternatively, many banks offer credit monitoring as an add-on with their credit cards. Both RBC and MBNA provide this additional service, and their prices are roughly the same as the credit bureaus.

Monitoring services come with a monthly charge, which tend to be around $20. That will seem fairly expensive unless you make full use of the information they deliver. They are particularly useful for anyone who is anxious about fraud or need expert analysis of their debt situation on an ongoing basis. But for most people, free services like Credit Karma may well be sufficient. It all depends on your personal preferences.

In any case, it definitely pays to investigate your credit score if you aren't already aware of it. Home or auto purchases depend on having a solid rating, and your score can often be improved. But there's no chance of doing so until you know where you stand. Businesses like Credit Karma and the major bureaus should get you started. But after that, it's up to you.

what is a good credit score in canada, free credit check canada, equifax, transunion, free credit report, credit karma review, is credit karma safe, how to check credit score canada, equifax phone number, transunion phone number

Comments